MedStartr Evolution: More Money, More Mission

by Alex Fair

Join us as we scale the MedStartr Healthcare Innovation Ecosystem and Accelerator

New York, NY United States Patient Power Tools! AI / ML Community Equity RaiseAbout our project

The problem we solve: Launching, Growing and Scaling innovation in healthcare is far more challenging than it should be. Regulations and powerful incentives exist to maintain the status quo and keep healthcare broken. Nonetheless, innovators innovate and they need a path to market that works reliably. When we see some of the best new ideas falter and fail, we know we have to do more, not just at early stages, but until healthcare works better for everyone, especially patients.

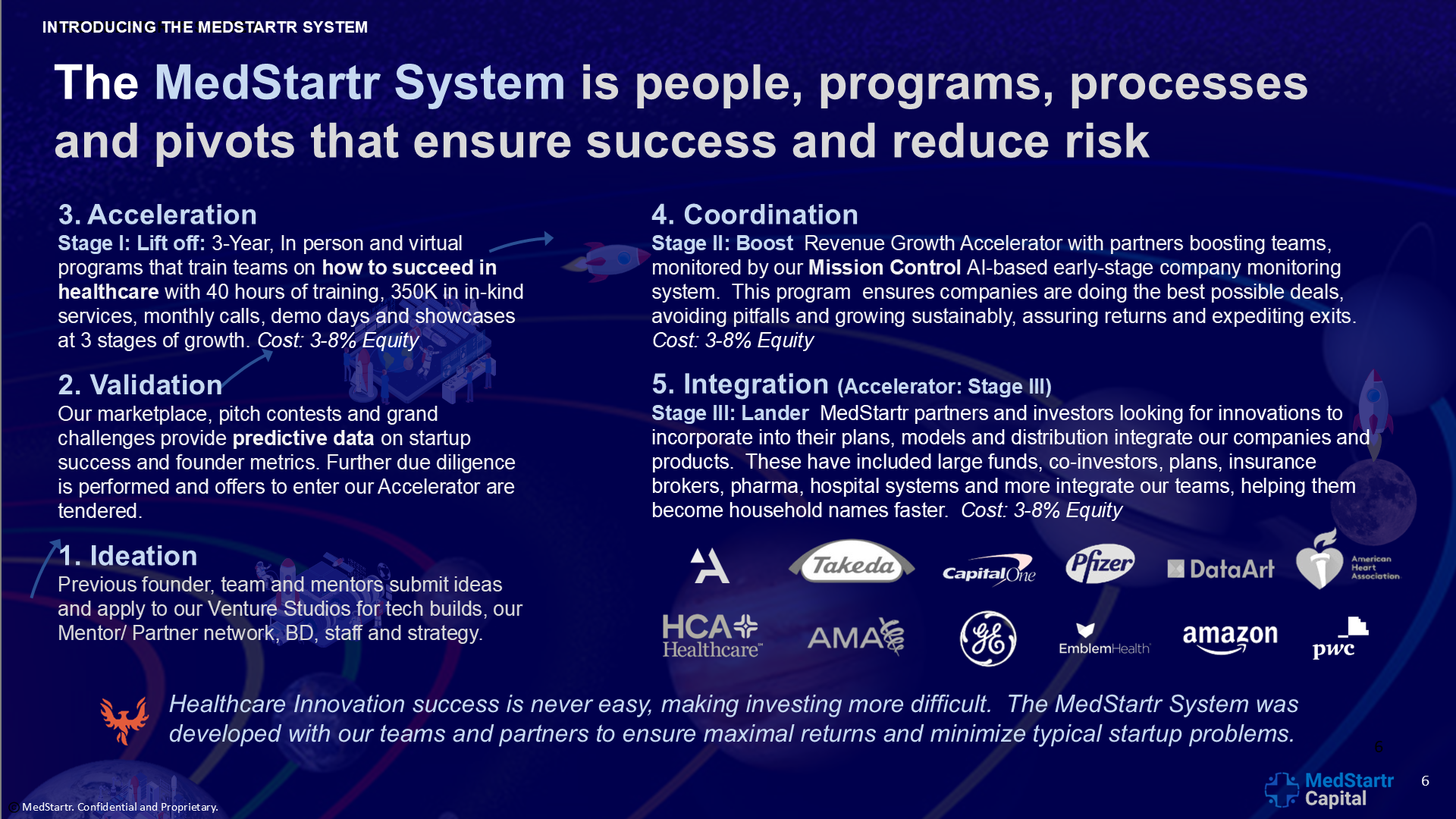

About our solution: We have built a system that helps startups at all stages, from ideation through integration into health plans at scale. It started with events where we saw teams forming, deals being done, mentors joining and ideas enabled. Next we created MedStartr.com to help the ideas get out of the lab and into the minds of like-minded people so they could get into care plans. Large Partners like GE and HHS asked to use the system to find companies to work with that Patients, Doctors and Hospitals loved, so we started running contests for them, finding companies like Medable, Alertgy, and UniteUs when they were little more than ideas. A few years later we learned how to invest and accelerate teams, developing one of the highest-performing early stage portfolios for our first two funds - based on what we call "Crowd-Validation". Our System and Accelerators operate now on 3 levels, Lift-Off, Boost and Lander to create sustainable change at scale with bigger sites, bigger crowds and bigger exits.

Progress to date:

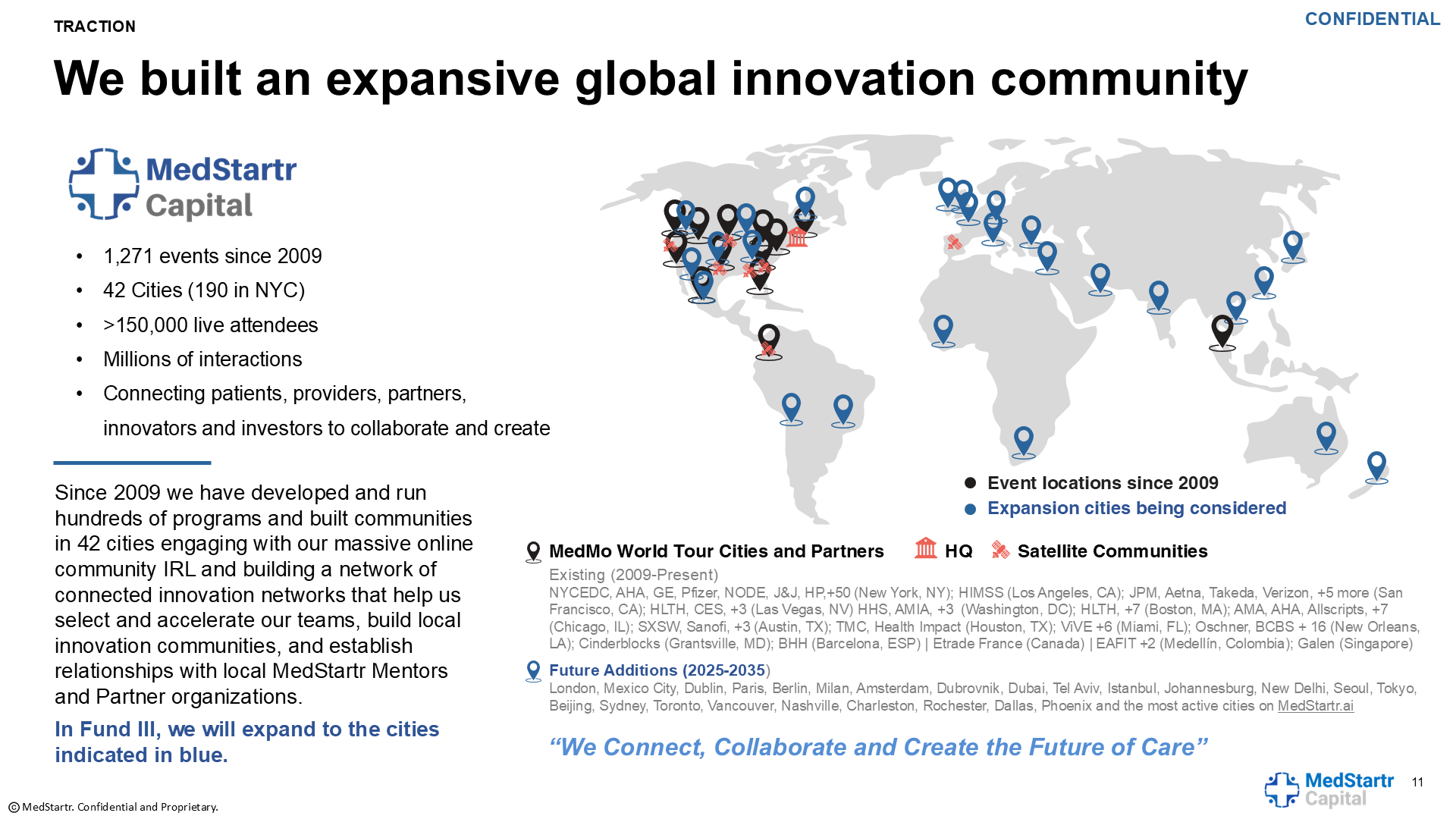

2008 - 2024: Building the Model

In sixteen years we held 1,275 events in 42 cities and online, enabling hundreds of thousands of innovators, investors, activists, adopters, and partners to connect in real life and drive the healthcare revolution that has been happening since then. We ran the first Health 2.0 Chapter and taught our methods and shared our chapter playbook with 217 other chapters, spreading the Connect, Collaborate, Create healthcare innovation model and message around the world. This site (first built in 2016 and ready to be replaced - we know) and many others we have created for clients, have had millions of visitors and have helped hundreds of startups, non-profits, and founders get the support they need to go to the next level. We have developed accelerators like NYC's HealthTech PILOT, NOLA's Healthcare Innovators and our own that have helped thousands of startups. We have helped inspiring Patient Activists like Regina Holliday get funded for their various programs and non-profits. During 121 contests and Crowd Challenges we have helped elevate hundreds of companies, some being acquired right off the site. Our Boost Accelerator (Business Development focused) has enabled hundreds of millions in sales, largely into hospitals. Last, but not least, our first Lander program sextupled RPM clients last summer for one of our teams when they were integrated into a system for that. Much of this was Agency or uncompensated work, doing what we love, but in 2017 we finally started our first fund to invest in the winners on our many platforms and challenges - to do good and to do well and have a sustainable business model.

Track Record of Our Funds

While we can't talk about fund performance here due to SEC and FINRA restrictions on solicitation of securities, let it suffice to say that while many healthcare VCs performed poorly and shut down through COVID, our funds did quite well. We are opening a family of funds now to enable teams from Seed to Series D as they grow. First close of the 3rd fund is imminent as we have had strong interest and a good number of commitments, some of which you will see posted here. All inquiries go through our FINRA licensed partner since 2017, Young America Capital (see Bruce Kaufman's profile at the right). There is a KYC form behind that "Invest" button over there => and a dataroom once approved to review, if interested. This is not an equity crowdfunding campaign, "Investors" are just expressing interest online.

2025-2035: More Money, More Mission

Our plan is basically to expand on the model, to scale up. This falls into three main areas:

1. Advancing the Online Platform: We are developing MedStartr.ai, a significant upgrade to this site which will allow innovators at all stages to find customers, partners, distributors, and investors, enabling rapid growth. Backed by our partners and funds, this will also become our best way to crowd-validate companies and create what is arguably a foundation model to predict early-mid stage company success and scale and providing a way to go weel while also doing good.. Our new AI agents have been built that can answer all sorts of deep questions like, "show me the best new ideas for diabetics" and return many options, we are loading data, making a beautiful UX (we know this one is ugly) and that should be ready by October at this rate. We also brought this one out of its mothballed state and hope you like it still. It has tons of functionality like the community pages, profiles, and of course, three kinds of crowdfunding (Donations, Rewards and Investor Interest) as well as Pilot, Partner, and recruitment options. The whole idea is that when you get a crowd behind your idea - or when you join one - it enables early-stage companies to succeed much faster. We have seen it happen in our challenges and on this platform hundreds of times and we look forwards to scaling that effect. Our Mission is simply to help fix healthcare through enabling innovators and those looking for innovation. We have made great progress, but clearly the job is not done.

2. More Crowds, More Conetsts, More Communities, More Campaigns: We are running more CrowdChallenges, opening up new communities like Jasper's MedStartr Dallas and Sarah's Power Women (see links above), and growing our crowd daily with new innovators, investors and enthusiasts for improving healthcare.

Community Members: If you are a member of our communities and they have helped you, we hope you at least post a like here and update your profile. Since February of 24 we have been building an online community on WhatsApp called the MedStartr Salon with over 100 sub-groups dedicated to discussing all topics, conferences, and cities that are very active. If you are in that, or want to be, we hope you support this project under the "Salonistas" reward. That chatty creation will be integrated into the community pages - all of which you can see on the links above under "Communities".

Startups: We encourage all to get their ideas posted as projects (Crowd-Validation Campaigns) and to enter the 2025 National Crowd Challenge. CMS and so many other large healthcare organizations are looking for the best innovations to improve care and reduce costs and the leaders are looking to us to help crowd source and validate ideas, so get your innovative solution listed. We even have a reward at the right where we will help make your campaign great with our experts. We have also brought on a dozen new sponsors this year and run ten events so far in San Francisco, Miami, Palm Beach, NYC and online. We will be expanding our #MedMo World Tour, looking for the best startups, aligned partners, engaged investors and recruiting and training new community leaders. If any of those are you, support this project and we will reach out to see what we can do together.

What is a MedStartr Community Venture Partner? Our community management platform, originally built in 2018 for the New Orleans Healthcare Innovation Community by our partner DataArt (great job!), is being upgraded and rolling out across five cities now. With satelite communities in several cities already, we intend to enable community leaders in every major city to run events, accelerators, co-invest and scale our global healthcare innovation ecosystem with a hub and spoke model, enabled by our online platforms. With over 250,000 community members and 1,275 events in 42 cities, we have made great progress, but this is just the beginning. See figure below. If you want to start a MedStartr community in your city, take the CommunityStartr Reward at the right here and we will give you your own page,bing in all our local members, provide our playbook, help you get sponsors and bring the Healthcare Evolution to your area of interest, city, or existing healthcare innovation community. To see how big they can get please visit MedStartr.NYC.

3. Opening a family of funds (III-V) to invest and accelerate the companies you like best.

Our Family of Funds based on risk and stage: MVF III-V: While SEC regulations prevent us from discussing the progress of our funds, syndicates, SPVs, or past performance, we can say this has gone well so far and is why we can do all we do. It provides a business model that is beneficial to all and is a way we can get protect impactful ideas better (see Truth to Power poem at the end of the video.) If you are an accredited or institutional investor that fills out our KYC form AND is approved by our team that includes a FINRA registered Broker/Dealer, then you can access the "Investor Information" tab here leading to a full dataroom that has everything you need to know. In general, though, we have performed well while others in the healthcare VC space have not. If you would like to book a time to discuss, please contact Alex Fair or Bruce Kaufman, CPA, two of our founders.

Note: This is not a solicitation to buy or sell securities. All investing bears risk and all investors should be prepared to lose their entire investment. Past performance is not a guarantee of future results. Investing in MedStartr Venture Funds is only for accredited investors. Please review all investment opportunities with your trusted and licensed investment adviser.

About the 2025 National Crowd Challenge

The 2025 National Crowd Challenge you see in the links above on the site to crowd-validate and select our next accelerator clas for the first ten of 130 companies we will invest and accelerate from Fund III. We have a number of warehoused deals for great companies, but we will use the challenge to find a few more. On average, teams that win our challenges are 22 times more likely to suceed, so this methology is well-proven (p<0.05.) Our accelerator entry comes with 100K in case and 400K in services and perks that startups love. Learn more at the link above or here: MedStartr.com/pages/NCC2025

About Our Team

Creator: Alex Fair

Location: New York, New York

Education: Medical College of Wisconsin

Bio: While working on his Ph.D. in Pathology at the Medical College of Wisconsin, Alex took a break to found his first health tech startup. That first company was bought by a company that had just gone public and he has never looked back, starting new companies and running them ever since. He still wants to cure cancer and fix healthcare, but now he does so by enabling hundreds of new companies to get to market faster and more reliably. He has also served as adviser or mentor to over 120 startups.

Title: CEO / Managing Partner

Advanced Degree(s): MS

Twitter: MedStartr

About Team Members

Robert Schinazi

Managing Director: Mendical Devices, PhD

Biography: Leads turnaround programs / Venture Studio, engineering due diligence. Master builder with 30 years developing devices, systems and robots for Dexcom TI, HP, JBL, Bose, and more. BS, RPI, Ph.D., Clemson

Title: Managing Director: Mendical Devices

Advanced Degree(s): PhD

LinkedIn:

https://www.linkedin.com/in/robert-g-schinazi-ph-d-1a416927/

Sharad Mishra

Venture Partner, MBBS, MBA

Biography: Led MedStartr due diligence teams since Fund I. Apollo-trained physician with a medical device and CVC background. 15+ years corporate M&A, fundraising, and ops. Successful 2016 startup exit. Ex-Optum Ventures & Lab Corp CVC. MBBS: Himalayan Institute of Medical Science, MBA: UVA / Darden

Title: Venture Partner

Advanced Degree(s): MBBS, MBA

Twitter:

@CrowdfundVC

LinkedIn:

https://www.linkedin.com/in/drsharad/

Jonathan Fair

Managing Director: Business Development, MBA

Biography: Built and leads MedStartr Busines Development efforts and the Boost Accelerator program for our portfolio companies. He has spent 30+ years as strategic leader in media, real estate, and healthcare working for the City of New York under both Bloomberg and Guliani. In the private sector he managed the development of some of the largest developments in NYC and beyond such as the Edge and the Barclays Stadium representing over $20B in projects developed. He also managed NYC’s 9/11 response under two mayors. BS Syracuse, MBA, Baruch.

Title: Managing Director: Business Development

Advanced Degree(s): MBA

LinkedIn:

https://www.linkedin.com/in/jonathan-fair-6584358/

Robert DeLeonardis

Partner, HK

Biography: Robert DeLeonardis is a strategic advisor and private equity investor. He managed multiple liquidity events in various companies where he served as both principal, investor and leader across various industries. In his role as Partner at MedStartr Ventures, Robert brings relationships across a wide range of businesses and a deep skill set in leadership, growth, strategy, restructuring, deal-making, and operational improvement to support portfolio companies and identify new investments. He has played an active role in turning around several early-stage ventures and guiding successful exits.

Title: Partner

Advanced Degree(s): HK

LinkedIn:

https://www.linkedin.com/in/robert-deleonardis-ba169970/

Bruce Kaufman

Managing Director, MBA

Biography: Bruce has been in investment banking for 30 years, raising 4B in capital for healthcare innovations. Co-Founding MedStartr Venture Partners with Alex and Sharad in 2017 h has been a pivotal team member enabling a doctor and a scientist to raise their first fund, learn to do due diligence properly, manage growth and maintain compliance.

Title: Managing Director

Advanced Degree(s): MBA

LinkedIn:

https://www.linkedin.com/in/bruce-kaufman-58493a8/

Jasper Cannon

Venture Partner, Community Organizer: Dallas, MSMKT(c), CSSGB, CSM, CSPO, CSBI, CSAF

Biography: Originally one of the most active "MedMods" in our 18K member MedStartr Clubhouse community that ran 40 shows a week when we had no other way to engage our community during COVID, Jasper has become a key member of the MedStartr team representing us in Texas, on stage, and around the country. He brings deep analytical skills and knowledge of the healthcare system, finance, and innovation. He leads our new Dallas MedStartr Chapter and is a member of our due diligence and IRCs. Join him at his next event!

Title: Venture Partner, Community Organizer: Dallas

Advanced Degree(s): MSMKT(c), CSSGB, CSM, CSPO, CSBI, CSAF

LinkedIn:

https://www.linkedin.com/in/jaspercannon/

Avisha NessAiver

Chief Science Officer, MS

Biography: In addition to his work on DistilledScience.xyz and leading Birya Biotech, Avisha helps out on MedStartr events, business development and due diligence teams since we started investing in 2017. He is a polymath with a flair for engagement through his videos, posts and various social media platforms with a specialty in medicine and science education and promotion of innovation. BiryaBiotech.com is also a MedStartr.vc Fund II portfolio company that has created a system for refilling Epipens, check them out here or on BiryaBiotech.com

Title: Chief Science Officer

Advanced Degree(s): MS

Twitter:

@AvishNessAiver

LinkedIn:

https://www.linkedin.com/in/avishanessaiver/

About Our Company

MedStartr, Inc.

Location: 67 Pitt Street

2nd Floor

New York, NY 10002

US

Founded: 2012

Website: https://medstartr.com

Blog: https://about.medstartr.com/blog/

Twitter: http://x.com/MedStartr

Facebook: http://facebook.com/medstartr

Other link: http://medstartr.nyc

Other link: http://medstartr.vc

Product Stage: In the Market

Employees: 5-10

How We Help Patients

The ultimate stakeholder in all healthcare innovation is all of us, we are all patients sometimes. We lose people we care about because our solutions to the problem of living long and healthy lives just aren't good enough yet. But we believe in human ingenuity and there are few problems humanity can't solve if we try. But we, as patients, rarely have a say in what new ideas get to market and into our care. We started MedStartr to help all of us be involved in that process because what we saw in our first week after launching MedStartr.com on Independence Day, 2012 was that when patients got behind an idea, doctors, hospital leaders, governments and big companies paid attention. A few months later one of the largest investment funds, GE's Healthy Imagination asked us if we could help them find innovations Patients, Doctors, Nurses, and everybody loved, so we created the MedStartr Crowd Challenge platform you see here. Since then we have helped hundreds of new ideas Get Startd. Innovation in healthcare is particularly difficult making it one of the least innovative industries, but when people get behind an idea on MedStartr, it de-risks a hospital or investor to give the new idea a chance. Patients using their voices here are heard and among our top criteria for our funds for the companies we give our all to enable. In the end, companies like Medable, UniteUs, Alertgy, YourCoach, CareandWear, CareSet, Misfit Wearables have been helped along the way by patients that loved their idea and expressed it here on MedStartr, enabling them to improve Clinical Trials, Care Coordination, diagnostics, Health Coach networks, hospital gowns, access to their data, self tracking and so much more. Patients and their care givers like the current Acting head of DOGE, Amy Gleason also got their ideas to help people they love be healthier too, creating companies like CareSync, Caring Bridge, FMDchat, The Walking Gallery, Crohn's Disease Warriors, Maternova, Saving Mothers, and many more that have improved healthcare. So we ask that you please review all the new projects on the site and support those you like. Do reviews and get involved. Healthcare innovation is not a spectator sport, butyou can be part of the action here. Click the "Try" button, like, follow, share, post a review or comment, take rewards, give donations (they are tax deductible in many cases), or put your idea out and see what help our crowd can provide. Thank you for reading and being part of the evolution of healthcare in a more patient-driven and patient centered way. There are a few patient rewards at the right, so if you want to support the mission we are on, we are always appreciative too, but its really about the innovations on the platform, not us. We just help where we can. They do the real work of fixing healthcare for patients everywhere.

How We Help Physicians

About a third of the ideas we have helped have come from Physicians, Nurses, PAs, Physical Therapists, and many other care professionals. New categories of care professionals have also been created here with Health Coach Networks that are now being offered as a service to employer plans (YouCoach.Health) and Patient Advocacy Services by people like Grace Cordovano, our Patient Activist of the year in 2018 have become far more viable as a sustainable service that is being offered more and more. Healthcare has been evolving in myriad ways and we are proud to be able to provide platforms to drive awareness, assistance, investment and adoption.

As a person who provides care, we know you are even more frustrated by the limitations of the system for care and the tools available. We know, the MedStartr team has many refugees from the "System" and we have done many programs to help care professionals use their skills to improve care in innovative ways. We help them get out to market, drive sales, and even sell their companies so they can work on their next idea faster.

So how can we help you?

For your Practice: Find Innovations here, get behind them and offer to Pilot, Partner, Mentor or invest. Your "Like", "Follow", and reviews also make the team's scores go up three times faster than non-clinical folks. You are subject matter experts on how care actually works, so we value your opinions and engagement with ideas you think will work in the work that you know so well.

For Your Innovative Ideas and Companies: We love helping clinicians get their ideas to market. Our first two investment exits were started by an ED doc/ EMT Team and the husband of a Physician solving a problem she described to him. Your expertise is key, but we know you went to Med School or Grad school, you didn't work on Madison Avenue or Wall Street, so you may not know what to do or who to talk to next. That was me 30 years ago when I dropped out of my Pathology PhD. I started a company to help fix the LOMN-based denial problem for a large physician practice management company in the 90s. It worked well and I let my team and I get aqui-hired for peanuts while the system doubled the revenue across 1,000 physicians once we applied to 156 other types of denials. So we have lived that experience through our own mistakes and hundreds of others we have seen and now help others through. Now we know how to help you avoid them too and prevention IS the best medicine. We can help you get it right the first time and teach you how to do it every time, not just for better exits, but better starts, growth, and sustainability. Just ask Michelle Longmire, MD, CEO of Medable who got their first funding on MedStartr while she was a Resident at UCSF. Her company is worth about 3B now and has changed healthcare for the better.

For Your Portfolio: You have the expertise on how ideas will work in your practice and we value that. Join as a mentor (click edit profile and apply) and we will add you to our panels of expert MedStartr Mentors who are part of our accelerator and due diligence process. You get to see the data we do that no one else has on how people really feel about innovations. Want to know if patients will love an idea, we have the data and share with those who help. Click the invest button if you want to get in on some of the best new ideas through our various methods. Please also see the disclaimers everywhere about this not being a solicitation to buy or sell securities. As a MedStartr Mentor you are able to co-invest in the same rounds as us based on your accredited investor status, the deals available and your own decision making if you contribute to the due diligence and crowd-validation process.

Note: the "Invest" button is not an actual investment, just interest in investing and the required SEC forms to KYC (Know Your Customer) as we can only, at present, allow accredited investors into our funds.

How We Help Hospitals

Pioneers in the hospital innovation program space since 2011, we have worked with dozens of hospital systems and helped bring Hospitals into the innovation space. We have designed programs, set upcontests, run challenges and more. On the most basic level, as hospital leaders and staff, your engagement with ideas here on MedStartr is a strong signal that an idea will be successful in the market, especially with you. As you know, this is critical for many innovators and your clicks count for much more. Our systems credential everyone who clicks and assign hospital leaders and staff more weight to their clicks, views, ratings,... 126 different ways based on our ADMP (Assesses Decision Making Power.) This helps all of us put our efforts behind the teams with the highest scores from a crowd of your peers AND all the other stakeholders in healthcare. But what starts on MedStartr doesn't usually stay on MedStartr. Often institutions find innovations that they implement and invest in, so that is the real benefit as an individual working at a hospital.

On a larger scale, if you want to have the most innovation-focused care centers in the world, running programs with MedStartr is a great way to get that going. We do our programs only marginally above cost because having hospital partners like Oschner and HCA offer grants, contracts and Pilots to the winners increases deal flow and crowd-validation. We even made a self service option where you can se up a challenge yourself. Here is one of a series we did in New Orleans: ( LINK <=link) for three years, as an example. We invested in two of the winners and they have done quite well. See the rewards or hit the Partner button at the right to start that discussion.

How We Help Partners

Tens of thousands of leaders from every major healthcare company have visited our platforms, attended our events, and connected with innovators since we started in 2008.This has helped improve healthcare in ways. When people connect, they often collaborate, and co-create the future of care. We help Partners find new ideas to work with, distribute, implement, invest in and sometimes acquire right off the platform in the 4th day of their campaign.

Our first major Partners GE and HHS/ONC sponsored the development of Crowd Challenge platform, now built into this site, way back in 2012. They did it to get an enormous focus group, our site users, to help them pick which companies to Partner with and maybe invest in. Since then over 165 large organizations like medical associations, cities, countries, and some of the largest companies in the world have used our help in similar ways.

Outsized ROIs for our Partner Programs

While not all aspects are quantifiable, we have a long history of producing disproportionately great results. Here are a few examples:

+ For NYC we designed the HealthTech PILOT program resulting in Mayor Mike Bloomberg allocating 3.4M into the program. Within a few years the investment inHealthTech increased 13 fold from 68M to over 883M according to Business Insider. The next year just 1 deal in NYC was 2.1B.

+ Takeda ran a Crowd Challenge to promote a new depression drug brand, drove awareness, and we see the winner's product in drug stores now

+ Bausch & Lomb bought a company they found getting traction on the site and that product is in the market.

+ The Innovate with AMA challenge recieved 396 applications (13x the year before), became the #1 site for Physician Innovation and signed up the first 5,916 members of what came their Physician Innovation Network in five weeks.

+ The City of New Orleans won a Global Innovation award for a series of challenges and community we built there (207-2019) and has since become one of teh best cities in the world for healthcare innovation

Click a Partner Reward and Let's discuss how we can help your organization Partner, Pilot, Invest and Adopt the most crowd-validation innovations with our programs. We also may co-invest in the winners!

Partner People Power Ups

While those are great, we think the education and engagement of corporate and municipal leaders with the innovators leads to the the most beneficial aspect: Innovation Virality and personal Power Ups. Anyone can come to our events or wander the platform and be inspired by the creativity and innovation they learn about. When they get back to work some say it infects all their work and allows them to believe things could be done differently, driving change from within. Leaders we work with rise quickly and get appointed much bigger jobs, run Corportae Venture, start innovation programs and much more.

Driving Distribution and CVC Benefits

MedStartr provides early-stage companies entrance into the system that gets their producds and services into distribution channels and into care. Helping two of our Fund II Portfolio companies into the largest hospital system in the US, for example, didn't just help provide great returns, but also brought better care out to millions of people. This has tremendous impact and also improves what our friend and advisor Cheryl Pegus calls Health Value-ROI (HV-ROI see link => Health Value-ROI.) The Partners often invest in the companies and participate in the success they help create as well. We work with several major organizations, crowdsourcing, crowd validating, due diligencing, accelerating and CVC co-investing in solutions that fit into their channels so everybody wins and there is less risk for all investors.

Getting Started in Partnering with us

Choose a Partner or other Reward at the right or hit the Pilot or Partner button if you want to book a time to discuss. If we have helped you or your organization in the past, please drop a like or make a tax-deductible donation. Healthcare is changing fast and the innovations are accelerating at the pace of AI-enablement now. As you know, that is very fast and figuring out which ideas are the best is no easy task. We can help.

Innovation Details

Intellectual Property Summary

Our IP resides is several categories, each is discussed herein:

1. Trademark /Branding: The MedStartr Brand is well established and a trademark was issued in 2012. Our unique logo representing the 4 key stakeholders in healthcare innovation: Patients, Providers, Partners and Institutions holding hands and making a safe space for innovation, is well recognized and in frequent use with hundreds of thousands of followers on social media.

2. Community / Collaboration: By building a community locally and globally since 2008, we have one of the strongest groups of healthcare innovation activists, builders, adopters, and investors we are aware of. While there is no protection of such a community, this community and how we have managed the growth and expansion of that community is open source. We publish rules of engagement and have built a culture and hundreds of community leaders who help the community grow and thrive. This is a methodology we freely share within the community and also train other community leaders, both within and outside healthcare, on the same. As with all community building, sharing this IP builds bridges and enables inter-community collaborations and relationships when goals are aligned. As a founding member of Together.Health, for example, a community of community leaders, we collaborate rather than compete and follow the mantra, "One Tide lifts Many Ships."

3. All Software and Content is copyrighted, but this doesn't really protect anyone except maybe from content farms. Many organizations have seemingly "copied" us, but honestly, who cares? If the goal is to drive healthcare innovation, then we are happy to help. Building software is simple these days, and no one would want this code :) The agentic AI version we are building next may be a different story and we may submit some patents around that. We have done that before and have been awarded many for our portfolio companies and previous companies including ones on your phone and life now (Alex was the Scanbuy.com Co-founding CTO.) Passion can not be stolen, and that's the secret sauce around here: projects fueled by personal experience and the idea that we can make healthcare work better for everyone. To this point, we have learned a great deal from organizations like Health 2.0 and so many of our community members, and even count Matthew Holt among our advisors and key influences. We also "hyper-collaborate" with those who share the same passion for impact in healthcare. In point of fact, we have made 32 white-label versions of our software for collaborative organizations, built networks and communities, designed award-winning city and country-wide health innovation programs, and taught our proprietary processes to aligned leaders and organizations all across healthcare. We consider teaching the MedStartr methods core to our mission of spreading innovation enablement and are happy to partner with any organization with similar mindsets. If this is you, please choose a reward that suits you, and let's schedule a call.

4. Algorithms, ML, AI, and our LDM: MedStartr has developed myriad proprietary algorithms to assess and predict the companies most likely to be successful since 2012. We collect data in over 100 ways to do so, many of which are impossible to do without the unique websites we build. We are constantly adding new analyses and now, with the help of AI, even deeper dives into the data. We keep these methods trade secrets and while most are obvious from using the platform, many data sources and transforms are only performed in-house and thus kept confidential. What you see as the "MedStartr Index" score on the site is a basic version. To access the reports from the full version, become a MedStartr Partner and run a challenge with us!

Clinical Information

A note on Clinical Efficacy for what you find on the MedStartr sites: All projects that are allowed to go live on MedStartr are reviewed for clinical efficacy data. If they do not yet have it, we require preliminary data and or, at minumum, a plan to obtain it, often through the MedStarrt platform. So for example, a reward could be participating as a clinical validation partner. As we are considered "pre-marketing" publication, the FDA does not require us to perform duties similar to their own, nonetheless, we do not want to support claims not yet validated on our platforms and do our best to prevent such things. We are providing best efforts, but please review all claims for clinical efficacy you see on the platform and always contact the creators of any project if you have questions before you buy, take, use,... any product or service you find on the platform. Please Note: MedStartr, nor any associated companies, do not vouch for the clinical efficacy or safety of any of the products or services on this site or any others we created or will create. We only do some research, not enough to verify all claims deeply.

Startup Enablement Efficacy: A better question for us would be, How well does the system work for startups. The complete system including investment and acceleration has made us a top fund manager in the space, but you can only see those stats if you are an accredited investor. Sorry, SEC and FINRA are strict about this and we follow the rules. To learn more about that please click the "Invest" button at the right to fill out your KYC form so we are allowed to have that discussion, or more specifically our friend Bruce Kaufman at Young America Capital, a registered Broker Dealer, is allowed to have those discussions on our behalf. We maintain a dataroom here on MedStartr as many companies do, but you can only access that area after you go through the accredited investor validation process built into the platform.

Success Prediction Efficacy: A simpler question is, "how well do you predict startup success here on MedStartr?" We wanted to know that too so back in 2015, 14 months before opening our first fund, we comissioned a study across the first 2,644 companies that entered our contests or used the MedStartr platforms. We had collected data in only sixteen metrics and sliced off just the top 3% based on our early predictive MedStartr algorithms we had developed for our clients and startup founders. No additional review akin to due diligence or "cherry picking" was performed by the outside party (a 409A service provider) that performed the valuations for on average 15 months after the teams were on our platforms. That early MedSartr Algorithm predicted success 22 times better than a typical VC fund does, showing a statistically significant correlation (p<0.01). The predicted IRR of that portfolio was over 187%. At the time I didn't even know that was incredible, nor what IRR was, believe it or not (I'm a scientist Jim, not a VC!) So we read some books, got some amazing mentors to advise, and put our own money in to test the model with real investments and started learning the ropes on our own dimes. In the second year 27 other LPs came in and we opened our second fund. In the seven years we have been investing based on the much evolved data and analysis models we have validated the model with actual investments, gains and exits. We also have increased the data we collect and improved our algorithms exponentially Our IRR, MOIC, TVPI and exits to date speak for themselves and can be accessed through the Investor information areas of this campaign for accredited investors. What we have created is a Large Data Model on early stage healthcare companies. Our analyses, now being upgraded with ML and AI, represent an unfair advantage for capital that has access to these data and is arguably what they call a "Foundation Model" for startup success in healthcare. Our MedStartr Aligned Investor Network (MAIN), LPs and Partners get some access to this data as well and are invited to co-invest in deals we do SPVs for, Syndicate, or even in the same very early rounds we come into, especially if they can offer more than just money but also pilots, distribution and partnerships..

But to answer the question, 'how well does it work for the startups?' more directly, just know that VCs only succeed if their investments succeed. So if you win, you will be off to the races generally at a rate of 2x per year in valuation (pre-dilution). It is also noteworthy that even the 53rd place team in some contests get two pilots and 7 doctors backing the idea. In that Challenge we ran for the AMA, 130 teams got over 3,100 offers for partnerships, Pilots and "Other" alone and over 17,000 clicks overall in 5 weeks. Imagine what a few hundred engagements with this crowd would do for your idea - in just five week. These are customers and thats a win too. Being on MedStartr can be like having a booth at the biggest, most diverse conference filled with people who care about driving innovation for free. We recommend it for all healthcare innovators who need to do everything at once - awareness, PR, Customers, product definition, hiring, board building, fundraising,... That why we created MedStartr and we do love helping as many ideas get to market as possible, even if we don't invest. We created it for our own startup and our MedStartr.nyc community (the first of 218 global Health 2.0 Chapters we helped develop back in the day.)

*Note: This is not a solicitation to buy or sell securities. The "Invest" button is only an expression of investor interest, not actual investment. Past performance is not a predictor of future returns. All investment bears risk. Please discuss any investment decision with your trusted, licensed professional advisor. This site does not provide equity fundraising services, Reg CF or otherwise.

Regulatory Status

A funny thing happened with the FDA back in 2012 when we started. Paypal, back then the biggest online payment processor involved in crowdfunding, gave us 30 days notice to shut down because we were "selling" non-FDA approved health and medical products and services. So we set up a call with them and the FDA's legal lead for such things, Bakul Patel. Bakul explained to the Paypal team that what we were doing was considered "pre-marketing" research and was not only allowed, but encouraged as part of the process of enabling innovators in healthcare. Paypal backed down and we switched back to using Paypal two years later when they gave us a special deal for volume and because their tech was better.

Now that the FDA is run by an administration thatis extremely friendly to innovation, we are running the 2025 National Crowd Challenge to find teh best teams to get through the FDA on fast tracks in an unofficial capacity. Many of the people in the USDS initially got funded on MedStartr and we know they are still opening their many MedStartr messages as they are subscribed mentors in the network. These are some of the most innovative, creative, caring people we have ever been grateful for the opportunity to help on their journey to improve healthcare. Now they are in charge of many of the branches of government that control what ideas get into Medicare, Medicaid, the VA, IHS, and through the FDA. If you want their attention, we suggest you get on MedStartr.

As for the FDA status of the projects on the site, the FDA status is a required field and we review for all projects and involve ourMedStartr Mentor FDA experts as needed.

How we will use the funds raised

Three types of funding are available to innovators in MedStartr. We are using all three. Here is how:

1. Donations: Tax deductible donations are processed through our partner iHealth Trust. They take 4% and send a reciept. They use their 4% to advance healthcare innovation, as is their mandate. Paypal takes 3% and the other 93% goes to funding MedStartr.com, paying programmers, insurance, servers and the like. If you like the site, please donate.

2. Rewards: See each individual reward, but in general, margins on the rewards are at least 25% and about 60% goes to the cost of providing the goods or services you have selected. Profits will go towards building out the next platform, web development, event management, rent, insurance, and staffing. We have full budgets we can share upon request, but in rough terms, it is 70% development and 30% G & A.

3. Investor Interest: These are not actual money, they are just investor interest. After potential investors express interest they get access to our Deal Room and we set up a call if they are interested. Once the first closing for Fund III is done, we will utilize the funds to invest in and accelerate 130 companies as we have since 2016.

You can find a full budget in the dataroom for accredited investors.

Thank You

Thank you for your interest, support, ideas, mentorship and trust. As a website, community, accelerator and event platform builder for innovators and those that love them to connect, collaborate and create, we are nothing without you. We are inspired by the creativity and invention we see every day and have tremendous faith in what humanity can build if we work together. MedStartr has been a collaboration of hundreds of thousands of people and will continue to be. Our donors, investors, creators, and partners have been critical since our first campaign, where we built the first version of MedStartr (1.0). The GE Healthy Imagination fund (Lisa Kennedy), HHS (Todd Park), AHA (Cheryl Pegus), and many others sponsored the creation of the Crowd Challenge platforms (2.0) and the AMA (Jeff Blackmen / Meg Barron) and Takeda backed the creation of this platform which increased enagement 42-fold in the first month and helped even more companies get found and funded faster with 396 teams applying to win that first challenge on the new platform (3.0). We started our first fund and accelerator based on the data from that first challenge and the winner, Twiage, was our second fund exit. Now, as we augment the model with AI agents, deeper data, and a better user experience and more money to invest in and accelerate great ideas the crowd validates, we are looking to you, our crowd of healthcare innovators, adopters, investors, and impact-driven enthusiasts, to get behind this effort. We mademany rewards to choose from, accept donations and are happy to discuss investing offline or through our partners at Young America Capital, a registered and licensed Broker /Dealer. We have garnered a great deal of support already and look to launch crowd challenges, ecosystem expansion to more cities and MedStartr.ai version this summer.

Once Again, Thank you for your support of us and the ideas that we love helping get found and funded faster.

Yours Truly,

Alex Fair

CEO, MedStartr, Inc.

Managing Partner, MedStartr Capital

Organizer, MedStartr.nyc

Emcee, MedMo World Tour Events

Investor Info

Market Size

The primary revenue sources from the MedStartr system have been from our Accelerator and Venture Funds. The Accelerator provides operating capital for managing the websites, community, promotional aspects like publications and events and pays MedStartr Mentors, Staff, and Venture partners to help portfolio companies. As the Accelerator is a niche industry without a large market and self-limited by nature, this section will focus on the market opportunity for the Investment Banking side of the business.

Healthcare Investment Banking /VC was about 23B in 2024 with average returns of only 2.5%. In Healthtech, it was only about 10B in 2024.

We expect to capture about 0.01% of that in 2025 and up to 0.5% of that in 2027, amounting to 40M in 2025 and 460M AUM by 2027. Our intent is deploy 5M in 2025, investing in our first 15 companies by EoY.

MedStartr Business Development, Events, Crowdfunding and Agency-style partnership services at cost all generate revenue, make us sustainable, grow the network attract amazing things daily, and are big markets, but are not discussed here for brevity.

Projected 3 Year Growth

With the relaunch of MedStartr.com, the closing of Fund III and the launch of MedStartr.ai we expect 2025-2027 to be a period of tremendous growth in three main areas: AUM*, Deals, and Impact. (*AUM=Assets Under Management)

In our first seven years, we have done 19 deals in 12 companies. We expect to do on average 20 deals a year for the next five years in about 120 companies, ramping to a peak of 40 deals a year in 2027. We are ramping up this year and will grow 2.5x a year, each year with more capital to deploy. These deals will increase not only in frequency, but also size as our companies raise series A-D we hope to lead rounds and syndicate to our MedStartr Aligned Investor Network (MAIN). From our second fund, which only had 3M AUM we intend to raise 3 funds over the next three years to a total of 460 AUM. To do this we are scaling all aspects of the model from ideation to validation, on to three levels of acceleration and finally coordination and integration into a different way to do healthcare that is better, faster, and less costly. Within three years we hope to grow about 50x in our investing, revenue and impact.

Growing the Crowd

We have done 1,275 events to date in 42 cities and three countries. Over 275,000 people are in our various communities online and off around the world and in online platforms currently. Starting with 235 in our MedStartr.nyc meetup group when Eugene Borukhovich asked us to run a few events while he was gone for the summer of 2010, it has grown exponentially with our efforts and your participation. Thank you, and also thank you to Eugene for starting us on this mission and Matt Holt for inspiring the first ten years of it.

Over the next ten years we expect the community to expand commensurate with how well we create platforms people and organizations love. They platform you are on now is slowly being replaced with our next one as this tech has outlasted its warranty and its time for version 4 of MedStartr, which we call MedStartr.ai. Various rewards at the right will help you get involved in that. We are here to serve the community and partners like GE, Takeda, Aetna, HHS, AMA, AHA, AMIA and 150 others have aligned with us to create all we have built. We look forward to our next partnerships from Aligned organizations. Start a local MedStartr Community, invite us in to co-create amazing things or get involved. We will need alot of help in many areas. Thats what the buttons are for! We can’t do this without you, a crowd that cares about improving healthcare, we see this as impact capitalism for healthcare.

Revenue Model

Since we have operated in many areas, let us address each briefly. For more information, please apply for the investor information. Unlike a point solution, our platform has many areas that generate revenue and work together as a complete Healthcare Innovation system. We initially created it to help very early-stage ideas from our community, but as the size and scale of the companies and investments have scaled, so have our methods. As it is rather unique and the revenue is primarily from the Funds and Accelerator. Each revenue stream is discussed but in short, it’s all about exits for real revenue. We have had a few already and we expect more. Sustainability is provided by admin fees on the funds (2%) and the Accelerator revenue we earn for helping the teams we invest in.

Crowdfunding: With over 300,000 healthcare innovations, the market opportunity to help them with crowdfunding is rather large, but realistically, as a crowd validation site, this is not a revenue model we would invest in if it did not also support the unique fund / LDM / Algorithmic investing model we have created. This is why the big crowdfunding sites are broadly-focused and why most niche crowdfunding sites (like ours) went away as crowdfunding pure-plays. So for startrs, forget crowdfunding as a business. We don't really count on significant revenue from that, but we do love that it helps more startups than we could otherwise in many ways.

Agency: We also operated as an agency from 2012-2019, running large-scale crowd challenges for over 60 clients around the country from the AMA to Takeda. This isn't a bad business, but not one we want to be in. We want to pick our aligned partners, not just be hired guns. We quit our jobs to do what we can to help fix healthcare, so if our clients and partners have other goals, it isn't a good fit. So yeah, we don't count on doing agency work primarly. We were very good at it and even won a global award for a program we ran for the city of New Orleans, but at the end of the day, if it isn't net positive for driving change at scale in healthcare, we don't want to put our time and energy into it. That stated, if you are aligned on this, hit the partner button or take a partner reward and let’s evolve healthcare together faster. We do our partnership programs at cost as we love working with great partners ready to do pilots, co-invest, and drive impact.

Business Development: At the start of COVID, while running our War on COVID Crowd Challenges many organizations, including FEMA, HHS, large hospital systems, the State of New York,.. came to us looking for innovations that would help with the COVID Crisis. Obtaining PPE, Respirators and the like was almost impossible. We also had hundreds of innovative companies building solutions that these large organizations needed desperately. So one of our partners and a few MedStartr Mentors began brokering the deals between the innovators and those that needed the critical supplies that they were building out fast, creating our MedStartr Direct business unit. This grew into our partner company that now helps innovators get into large contracts. It is also the basis of our Boost Stage II Accelerator. The market opportunity is rather large, but since we only work with the innovators we invest in generally and we only expect to work with 200 companies in the next 4 years, the market is limited to about 150K per company in our experience, on average (we only take a small percentage of the sales we drive as we are also invested in the companies we work with generally.) This amounts to about 20M over the next four years for this division, but more importantly, over 200M in sales for our next portfolio companies So we can do well, but also do good for healthcare and our investors. With the launch of MedStartr.ai we expect this business to expand significantly, but it is too early to speculate on that.

Venture Funds: This is our primary business model since 2017. We run Accelerators, Funds, create SPVs and will syndicate our vetted deals to our MedStartr Aligned Investor Network (MAIN). It has proven to be the most beneficial way to both help drive innovation and generate revenue. We only expect to raise up to half a billion in the next few years and put it to work over the next ten years, investing in Seed through Series D rounds from three funds based on risk and investment stage. Healthcare Investment Banking /VC posted average returns of only 2.5% in 2024, which is why many healthcare VCs and Accelerators went out of business last year. We did not, largely because we created a system that supports innovators first and foremost. Our Mentor network, for example, gets involved quite a bit, putting in over 3,000 hours into our portfolio companies 2024, for which they were paid in equity and cash by the portfolio companies they helped (you can apply to be a MedStartr Mentor on your profile or through the Mentor button above, if interested.) We do not expect to capture more than 0.1% of this market but since we have been doing well with the model, the gains we hope for will likely be outsized. Venture funds keep 20% of the gains as "Carried Interest", generally, and this is where our focus is. Hypothetically, if 490M is invested and the average company is growing 4x prior to exit, the net gains are in the 2B range to return to investors minus the 20% carried interest, so 1.6B for them and 400M for the team that helped make that happen. This is in line with what we have seen in top-teir firms, but once again, this is not a solicitation to buy or sell securities. Please consult with your trusted advisor before investing. All investing bears risk and you could lose your entire investment. That stated, start the conversation and fill out the accredited investor forms that start with the invest button at the right if you want to learn more.

Accelerator: Like most accelerators, our mentors and staff are paid a portion of the money invested in the teams to help them with their expertise and our platforms and promotion. Every class we do is funded by our venture funds to accelerate the portfolio companies over 3 years with both in-person and virtual programs. This revenue goes to the MedStartr Mentors and lead MedStartr Venture Partner (MVP) that meet with their teams every month for three years to curate access to our programs, network and services as well as our our in-person kick-off week faculty and staff, and finally, our platforms, events and stages that help our teams. This sustains the business until exits and is why our teams exit and grow at the rate they have- our "secret sauce" if you will.

Competitors

We take a hyper-collaborative approach in all things, and you can see that in our "Competition" discussion herein. As investors and partners, we always seek a “Mutual Gains” approach with organizations that seek to drive impact in healthcare while also providing good returns. We have done this since early days when Startup Health, Blueprint Health and Health 2.0 Catalyst all grew or were founded out of our Health 2.0 NYC community (only recently rebranded as MedStartr.nyc) in New York. If your mission is to evolve healthcare, then we will always help.

That stated, there are very few pure healthcare VC / Accelerator plays comparable to the MedStartr platforms, community, brand and complete System for innovation acceleration. A few are briefly summarized here that are the closest fit we are aware of. Please reach out if we missed anything relevant. This is not intended to be exhaustive, merely an idea of how we play with others.

Startup Health, which does an amazing job of promotion, is no longer running funds. It runs promotion of their portfolio and a network access and mentorship program today. This may change and as friends and long time collaborators, we hope it does.

Daniel Kraft, MD / Digital.Health also has a healthcare innovation marketplace, fund and community. We admire them and think they are doing great work. We appreciate Kraft's approach and collaborate whenever possible. He does to tend more on the Physician-centric side and this is valuable, but we believe all stakeholders, especially Patients and those that love them should have a platform, voice and say in which innovations get to market and care plans. This is why Regina Holliday was our first Board Member and we support her work as well as that of hundreds of other patient activists. Also of note, MDdisrupt and many others are also doing great work in a similar space.

Hospital-Based Accelerators are pretty incredible and we have enabled and perhaps inspired, many. We worked with Oschner, HCA, and dozens of others over the years, even designing the first major Hospital-Innovator program for Mike Bloomberg, NYC’s HealthTech PILOT program, back in 2012. We look forward to collaborating with these impactful programs even more in the future and are in talks with several now. If you would like to have a home for your acceleration program here on MedStartr, click the partner button at the right or take a Hospital System reward and support the mission.

Rock Health - Rock Health started as one of the first healthtech accelerators and has evolved since then into Advisory, Rock Health Capital and no longer operates as a healthtech accelerator. That stated, we are deeply aligned with the founders and current leaders and expect to co-invest and collaborate more in the future. We do not intend presently to create an advisory service but will provide data if they are interested.

Early-Stage Data Analytics Companies - A large part of what we do is collect data on how the crowd reacts to innovative ideas. This is valuable data we use to guide investment decision, but we are not in the business of packaging and selling these data. We are working out a partnership with the best data providers in the healthtech space to drive more data into their systems and utilize a portion of their datasets to automate onboarding and discovery of these ideas in our next version. Once again, not competitive, collaborative with aligned organizations.

HLTH - The HLTH conference company has done a fantastic job of filling the void for Healthcare innovation conferences left by Health 2.0 and we have run our finals for our crowd challenges into their ViVE and HLTH conferences for years, as we did at Health 2.0. They have developed a deep and wide healthcare innovation ecosystem that we are part of. We intend to continue to collaborate with the HLTH team and perhaps enable their network to participate in the success they enable for healthcare innovators. We are discussing presently, maybe here :)

Others: Organizations like Y Combinator, Plug n Play, and Techstars do some of the aspects of what we do, but are more industry agnostic and do not primarily focus on healthcareor have the deep network we have cultivated since 2008. We have learned quite a bit from these great competitors and look forward to working with them as co-investors and co-accelerators as we have in the past and will in the future.

You: While MedStartr is presently somewhat unique, there is no reason others can not follow in our footsteps, and we encourage that, even assisting others to start funds and communities. We have a well-established brand, websites, network, and systems that have been developed specifically for our model. But when it comes to innovation, we are here for that first and foremost. This is why we try to help all other organizations that want the same thing. So if this is you, please reach out and let's talk and see how we can help. We have published over 30 white labelled versions of our platforms for other organization already, even brought in the first 5,916 members of an innovation network you have all heard of in five weeks with one of those programs. If you want to do that too, let’s discuss.

Traction

You can see many of our traction metrics for our activities above and in the Succesful projects and programs link. We also have had millions of visits to this site and oths, up to 500K in a month during a grand challenge. We have had huge traction in the past but we mothballed this site for a few years and honestly, we do not know how well this campaign or re-launch will go. You can see our traction best in how people are responding online with the metrics at the top right. So please, if you believe in our mission and methods, please click a button, take a reward, express interest in investing, or any of the 17 ways to engage with innovators on the platform. It is not enough to just talk about doing things, but let's do the things, togethor. Thank you!

Offline we have had very strong response to our Family of Funds and overall plan. We wil ask many of them to express their commitments here so they are visible, but not all will in all likelihood. We have over 2M in commitments to MedStartr Fund III already and soft circles of 20M into funds IV and V, so its a great start with hundreds in the funnel from our Investor event series we have been running this year. Many companies have applied to use the platform recently and our National Crowd Challenge coming up will be the relaunch of our Crowd-Validation methodology to find companies to invest in that the crowd loves. On average they grow 2-3x in the year after they win our challenges, so it is a really effective way to both find the best, elevate them, and drive innovation - even for the teams that place 53rd that get a few pilot, partnership and investor conversations started. In one contest with 130 teams for a client / partner, over 3,100 times that happened in five weeks and many came to fruition with the winner getting their first 12 hospital contracts in the next 90 days. The company was acquired after selling into a large percentage of the US hospitals and systems, was our 1st and 5th investment, and our second exit.

This begs the question, what is the performance / traction of your fund management. As noted previously, to access that information the SEC requires us to have you fill out a KYC (Know Your Customer) and validate accredited investor status. To start that process please either reach out to me (Alex Fair), Bruce Kaufman, or click the invest button. Please know it is not an investment commitment, merely an expression of potential interest.

Due Diligence Docs

Please note that access to the company's confidential materials is limited. Click this button to request access from the Company and its representatives.

Updates

-

Update #1

Thank you for your Very Early Support!

Thank you Josh Rubin, Trish Kane, Sarah Pustilnik, Mark Dingle, Ed Bukstel, and Regina Holliday for your very early support! Also big thanks to my Partners Jon Fair, Rob Schinazi, Robert and Healther DeLeonardis, Bruce Kaufman, Patrick Hurd, Jeff Borenstein, Komal Garewal, Gregg Masters, Lois Drapin, Matt Holt, Eugene Borukhovich, Deanna Dammers, and Drs. Atul Kumar, Ron Razmi, and Sharad Mishra for your feedback on this campaign and hard work over the years! We would never have been able to create MedStartr and all we have done without help from an enormous crowd of like-minded people and we are very grateful. Editing down for clarity before official launch on Tuesday, stay tuned! As the mathematician Blaise Pascal said, 'if I had more time I would write less' (paraphrased.) Early support in a MedStartr Campaign is key, so it is appreciated. Yours Truly, Alex p.s. Note: "Partner", "Pilot", and "Invest" buttons are not a contract for such, just the showing of mild to passionate interest and warm leads into deeper conversations.

Supporters

-

10/01/2025 - Interested in investing in the project.

09/10/2025 - Liked the project.

09/10/2025 - Followed the project.

08/29/2025 - Liked the project.

08/25/2025 - Interested in a partnership with the project.

08/25/2025 - Interested in a partnership with the project.

08/25/2025 - Interested in a partnership with the project.

08/25/2025 - Interested in a partnership with the project.

08/25/2025 - Interested in a partnership with the project.

08/21/2025 - Liked the project.

08/21/2025 - Interested in a partnership with the project.

08/21/2025 - Followed the project.

08/19/2025 - Liked the project.

08/19/2025 - Followed the project. , MPH, MHS, PA-C

, MPH, MHS, PA-C

08/18/2025 - Followed the project.

08/17/2025 - Liked the project. , MBA

, MBA

08/17/2025 - Interested in a partnership with the project. , MBA

, MBA

08/17/2025 - Liked the project.

08/17/2025 - Liked the project. , MPH, MHS, PA-C

, MPH, MHS, PA-C

08/17/2025 - Liked the project.

08/16/2025 - Liked the project.

08/16/2025 - Followed the project. , MBA

, MBA

08/15/2025 - Backed the project for $10

08/15/2025 - Followed the project.

08/15/2025 - Liked the project. , MS

, MS

08/13/2025 - Interested in investing in the project.

08/13/2025 - Liked the project. Instant Feedback

Instant Feedback

Help us find best new ideas to fund by telling us what you think. Your feedback goes straight to the team behind this project in private, so tell them what you really think.

94Medstartr

Index Score19

Interest

Score15

Adoption

Score11

Likes3

Partners0

Pilots2

Investors-

This campaign has ended but you can still get involved.See options below.

$300,035 pledged of $10,000,000 goal$300,000 Investor, Pilot & Parnter

interest to date.

Instant Feedback

Help us find best new ideas to fund by telling us what you think. Your feedback goes straight to the team behind this project in private, so tell them what you really think.